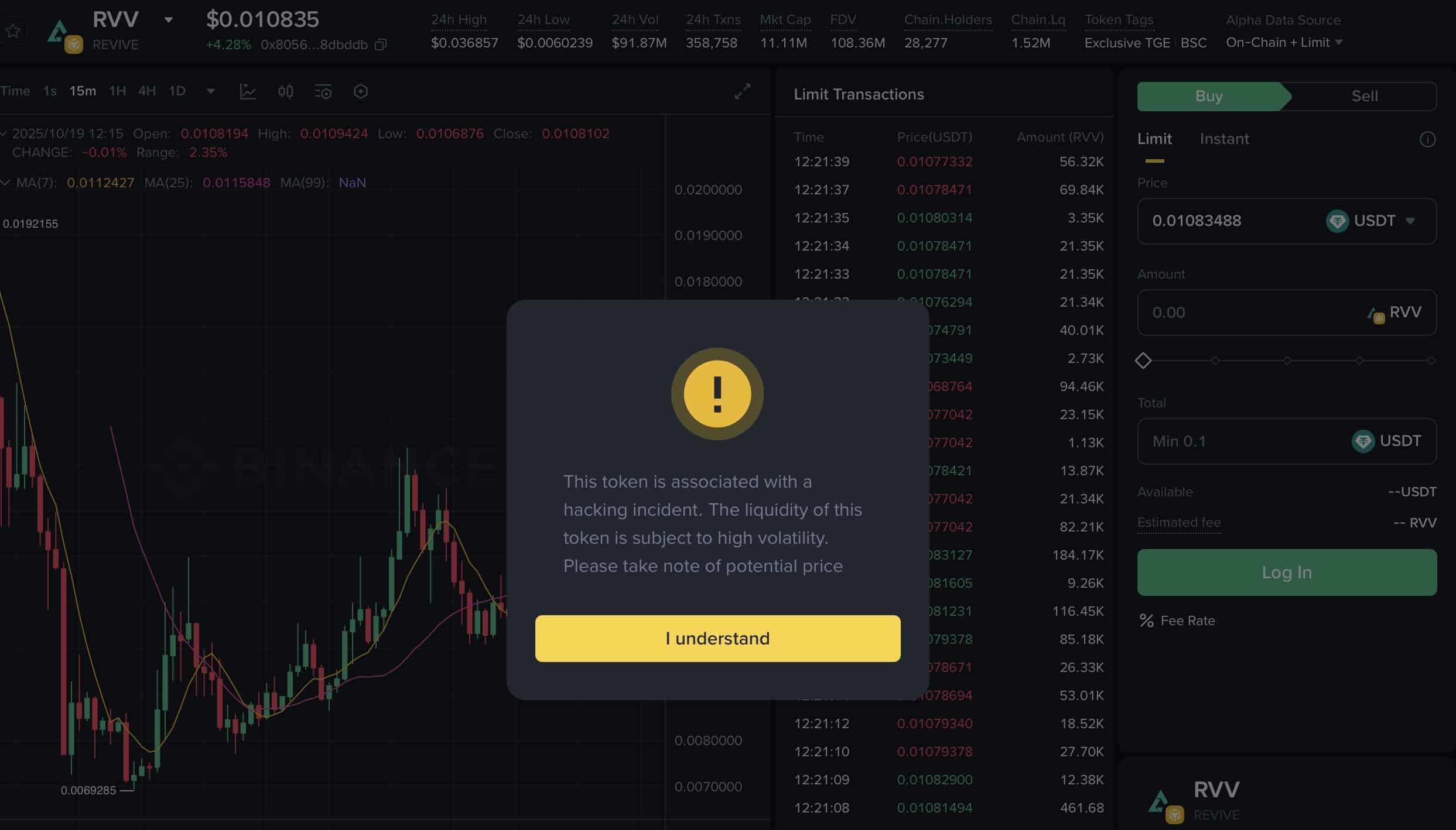

Astra Nova’s RVV token, one of the new Binance listings on Binance Alpha, is under heavy scrutiny just hours after launch. The project claimed that one of its market-making wallets was hacked, leading to the sale of over $2M in USDT from address 0x64…178C. Yet, on-chain data and community discussions suggest a much deeper issue, with many speculating that the event may not have been an external exploit at all.

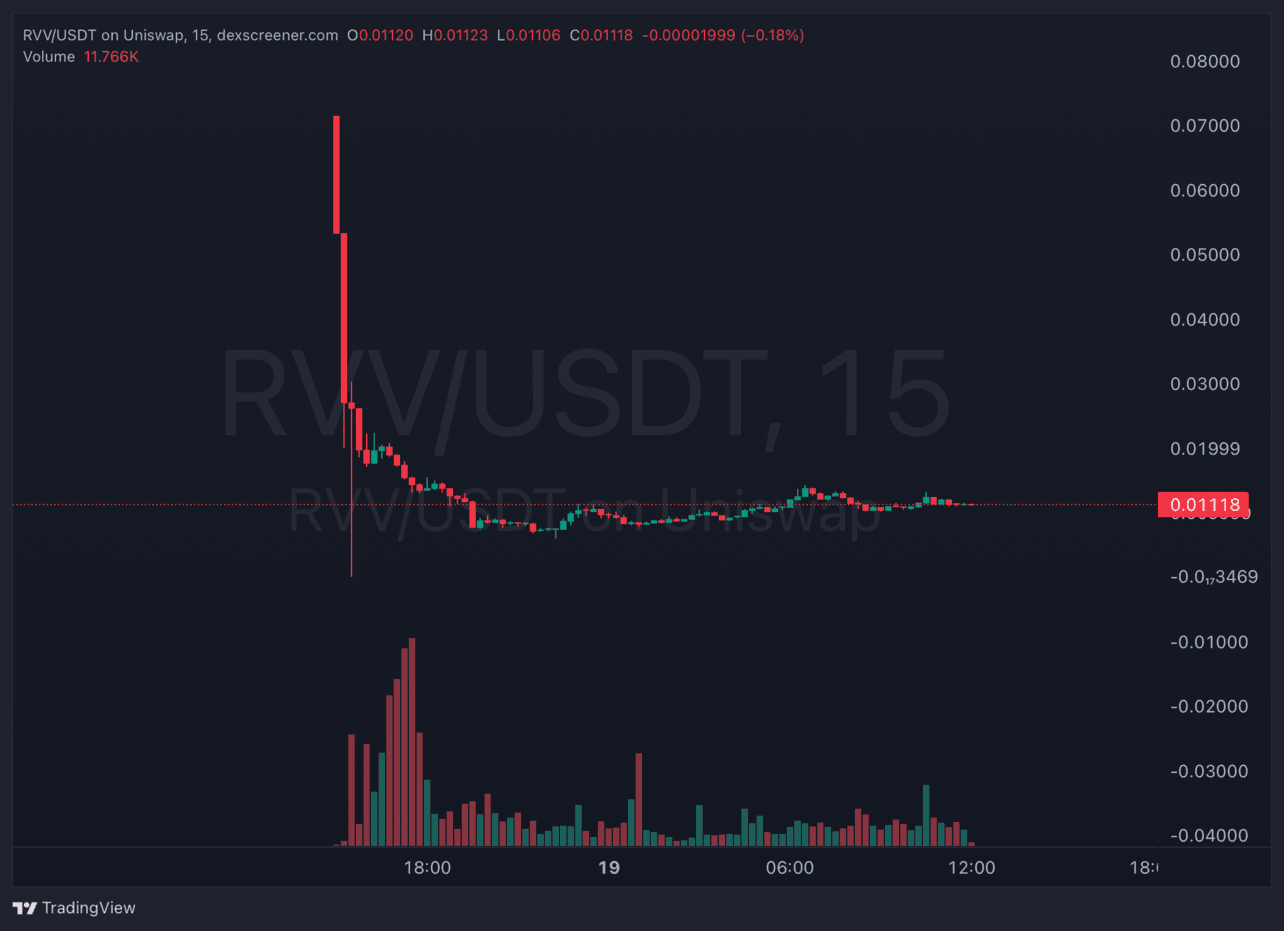

According to data from Lookonchain, 18 wallets dumped nearly 890M RVV, worth roughly $10.66M, shortly after the token went live. Around $8.4M in USDT was then transferred to centralized exchanges Gate.io and KuCoin, prompting allegations of insider involvement. The supposed hacker’s wallet has not moved since the sale, raising further doubts about Astra Nova’s version of events.

After $RVV was listed on Binance Alpha, 18 wallets abnormally dumped ~890M $RVV for ~$10.66M.

These wallets have deposited 8.4M $USDT into #Gate and #KuCoin. pic.twitter.com/sALBD2nKur

— Lookonchain (@lookonchain) October 19, 2025

Binance Alpha has since flagged RVV as “linked to a security incident,” warning traders about high liquidity volatility. The project’s Discord was locked soon after, and despite claiming to have raised $48.3 million, Astra Nova has yet to provide a detailed explanation to its community.

EXPLORE: 16+ New and Upcoming Binance Listings in 2025

Changing Vesting Terms, Missing Tokens, and a Growing Community Backlash

Discontent among supporters and KOLs has grown exponentially. The team initially promised 50% token distribution at TGE, but after launch, it introduced a seven-month cliff and one-year vesting, leaving most supporters with no claimable tokens. Many allege the project changed terms unilaterally, invalidated airdrops, and removed allocation visibility in the claim portal.

Users also point to inconsistencies: Astra Nova’s CoinMarketCap contract links to a different BSC project, and a multi-hour outage of the claim portal added to the frustration. The lack of transparency, coupled with threats to revoke tokens from users spreading “FUD,” has only worsened the community’s trust.

DISCOVER: 10+ Next Crypto to 100X In 2025

Whether this incident was truly a hack or a case of internal mismanagement, Astra Nova’s new Binance listing is now being viewed as a warning for traders chasing potential 100x opportunities: even when these are listed on Binance Alpha. Like they say: always DYOR.

RVV currently trades near $0.011, far below its initial price, as investors demand accountability from the team behind the project.

(Source: Coingecko)

Volatility Creates Opportunity: Why Traders Are Turning to Snorter (SNORT) Amid New Binance Listings

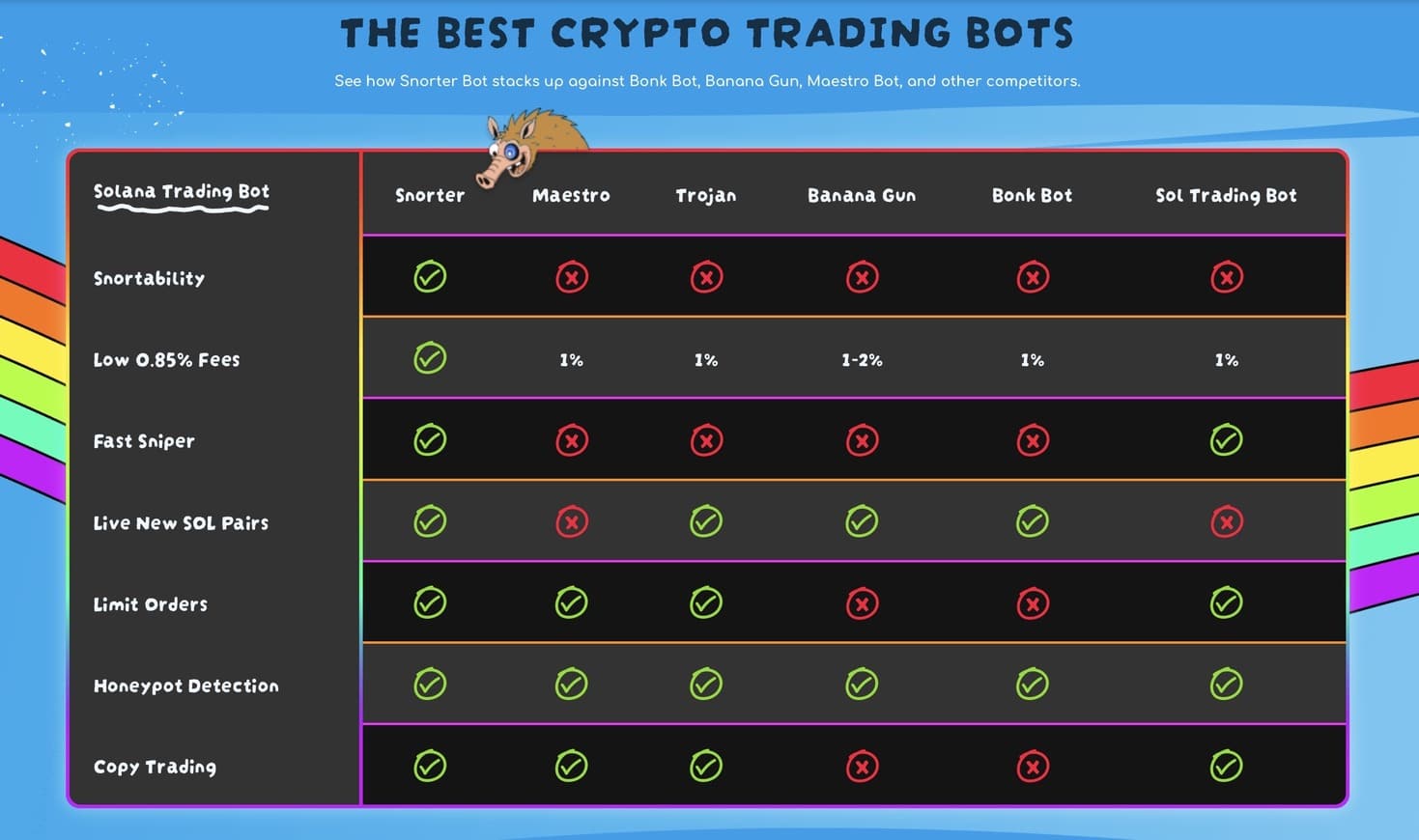

Despite controversies like Astra Nova’s RVV launch, new Binance listings continue to generate strong attention across the crypto space. These listings often lead to massive trading volumes and short-term volatility: conditions that can punish unprepared traders but reward those ready to act quickly. For traders seeking to use these market swings to their advantage, automation tools like Snorter (SNORT) are rapidly gaining traction.

Snorter is a Telegram-native trading bot designed for ultra-fast meme coin trading across Solana, Ethereum, Base, and other chains. Built for speed and precision, Snorter helps traders spot potential breakout tokens before they hit major exchanges, providing an edge in fast-moving markets.

With MEV protection, copy-trading of top wallets, and fees as low as 0.85% for SNORT holders, it combines efficiency with safety: a rare mix in high-risk environments like meme coin trading.

DISCOVER: Top Solana Meme Coins to Buy in 2025

Automation Meets Opportunity: How SNORT Combines Speed, Safety, and Smart Trading

The project’s presale ends on October 20, 2025, with tokens still priced at $0.1081 and over $5 million already raised. Staking remains open with an impressive 106% APY, allowing early participants to earn while waiting for the next listing phase.

Snorter offers a blend of meme-driven excitement and real trading infrastructure. Its algorithm scans live on-chain data, analyzing liquidity flows, contract safety, and transaction patterns to identify legitimate early-stage opportunities while filtering out risky contracts and shallow pools.

As Bitcoin’s seasonal momentum typically boosts altcoin liquidity in October and November, tools like Snorter could help traders capture profits at local tops or enter strong setups before exposure spikes.

With only 24 hours left before the presale closes, SNORT presents a chance to automate smart trading in a market shaped by every new Binance listing.

Key Takeaways

- Astra Nova’s RVV faced massive $10M sell-offs shortly after its new Binance listing, raising insider suspicion.

- Binance Alpha flagged RVV over a security incident as community backlash grew over changed vesting terms and missing allocations.