Can we get a crypto pump, por favor? Meanwhile, precious metals have hit all-time highs recently, and we’re finally seeing a new gold price drop. If all your TA brought you to this, what was the point of the TA? Might as well just flip a coin.

Spot gold plunged 6.3% on Tuesday to around $4,090 per ounce, while silver fell nearly 9%, as traders dumped positions after technical indicators signaled that the rally had gone too far, too fast.

So what’s going on with gold, and is this a larger indicator that we’re going into a global economic recession?

Gold Price Drop? Profit-Taking Ends a Historic Bullion Surge

Sorry, I sold when I realized outside of coins, bullion, and jewelry, there isn’t much practical use for gold in the modern world. Maybe fake teeth?

- Gold crashes 5% in a single day

- Can’t even buy coffee with it

What’s the point of this again? It’s clearly not a store of value or a currency.

“A drop of more than 5% is rare,” said Alexander Stahel, a Swiss resources investor. “In theory, it would be once in hundreds of thousands of trading days.”

BREAKING: Spot gold prices extend their decline to over -6% on the day, now on track for the biggest daily decline since April 2013.

The long overdue gold pullback has finally arrived. pic.twitter.com/xPEKXvF2Lm

— The Kobeissi Letter (@KobeissiLetter) October 21, 2025

99Bitcoins analysts say the latest correction doesn’t spell the end of gold’s rally but rather a necessary recalibration after months of speculative excess.

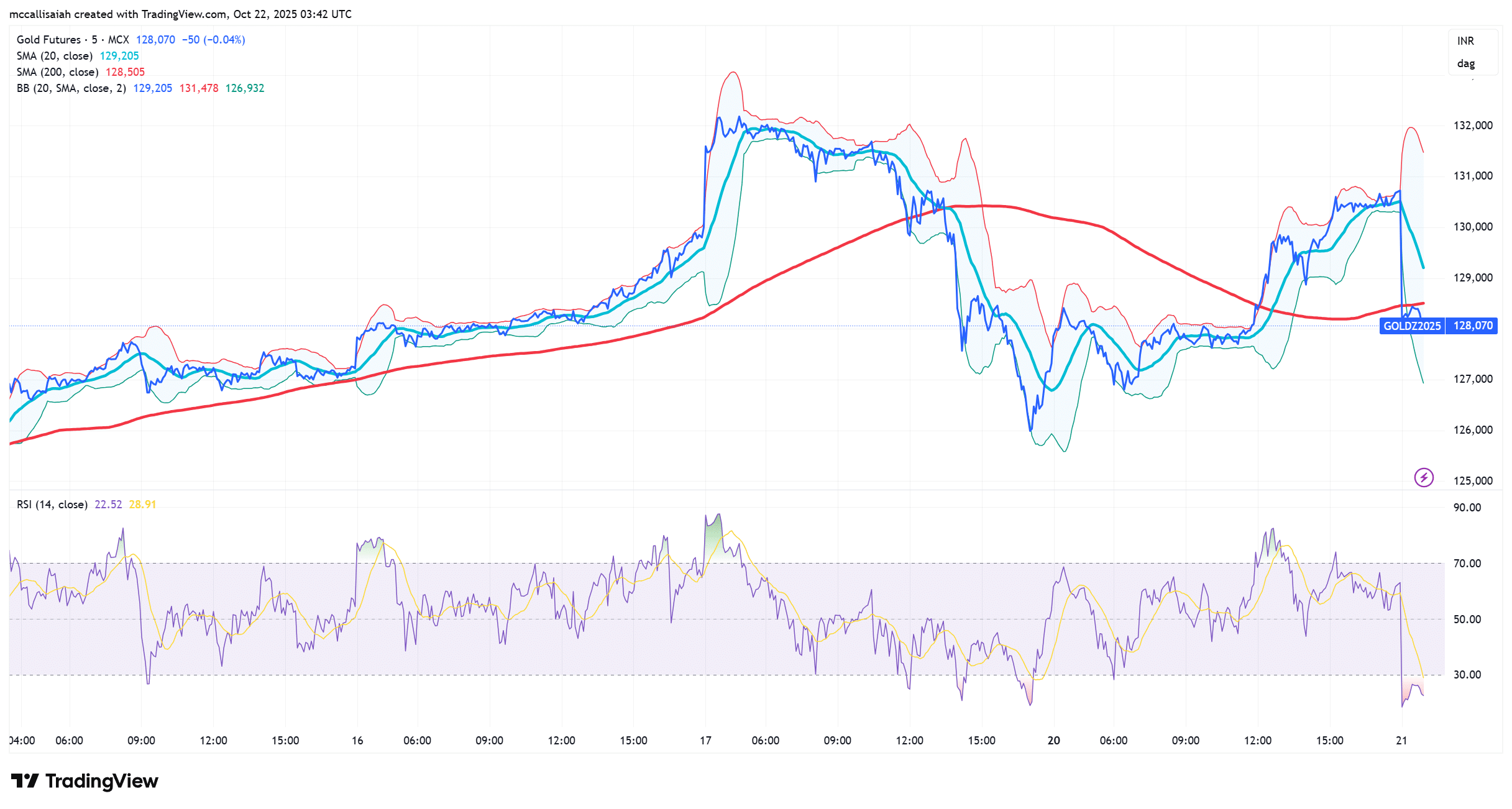

Gold Price Technicals and the Central Bank Pulse: Is A Rebound Happening?

Gold is clinging to key support around $4,000 – $4,050, a line that readers like gold bug Peter Schiff say separates correction from total collapse. The RSI had stayed overheated since early September for gold, and this setup was begging for a pullback.

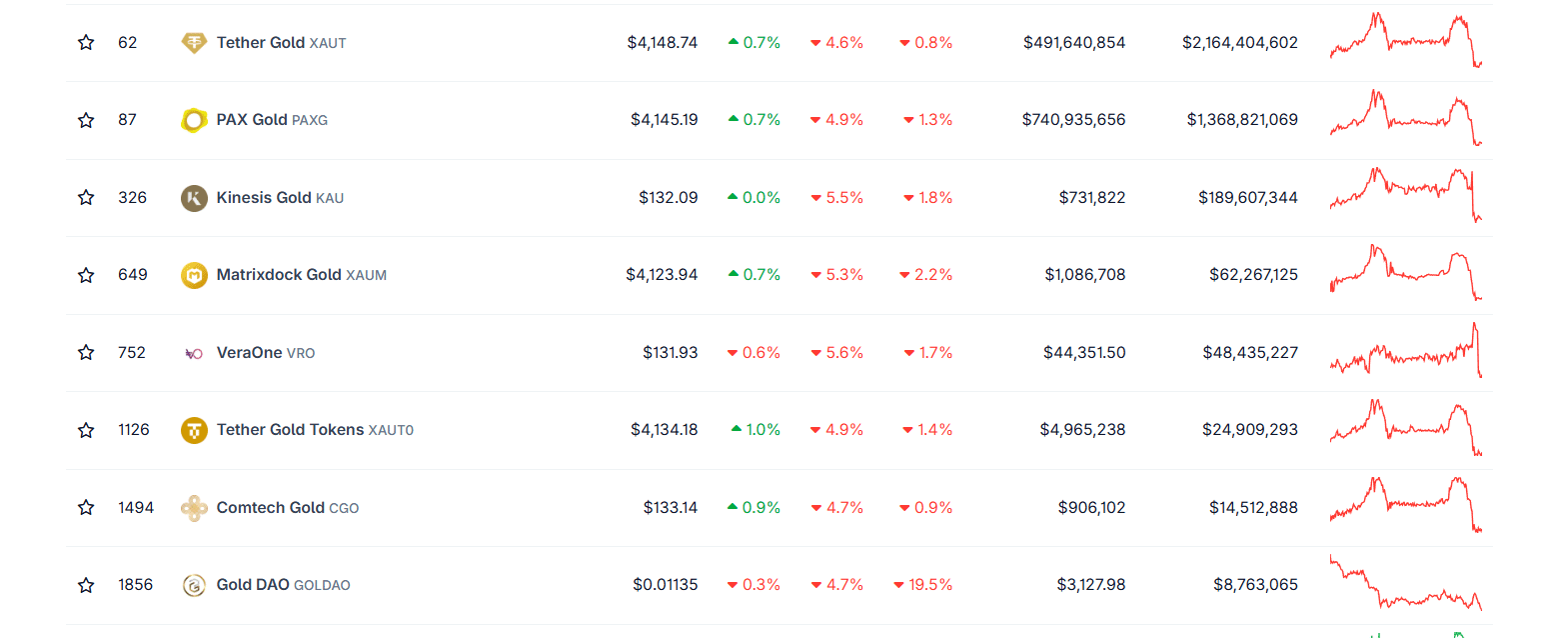

On-chain data from CoinGecko shows tokenized gold assets down 5% across Ethereum and BNB.

Meanwhile, the dollar’s rebound, driven by renewed talk of a US-China trade thaw, added further pressure to gold’s decline.

Citigroup: Gold Still a Long-Term Play, But “Overstretched”

Citigroup strategists, led by Charlie Massy-Collier, cut their overweight gold recommendation after Tuesday’s collapse, predicting a near-term consolidation around $4,000.

“Prices have run ahead of the debasement story,” Citigroup wrote in a note. “Central bank diversification away from the U.S. dollar will eventually return as a theme, but there’s no rush to position for that at current levels.”

The upshot is gold’s correction looks painful but overdue. For now, traders are calling it a massive but temporary reset, not the end of the bull market.

EXPLORE: Now That the Bull Run is Dead, Will Powell Do Further Rate Cuts?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Can we get a crypto pump por favor…meanwhile, precious metals have hit all-time highs recently and we’re finally seeing a new gold price drop

- or now, traders are calling it a massive but temporary reset, not the end of the gold bull market.